Vaulted Growth delivers integrated business banking, institutional-grade custody for digital assets and tailored lending solutions. Built for companies, funds and family offices, our web-first platform combines multi-currency accounts, programmable treasury, and access to tokenised real-estate financing — all within a compliance-first framework.

Flexible financing for working capital, capex and expansion. Products include term loans, revolving credit facilities and bespoke structured credit for corporates and sponsors. Underwriting combines traditional financial metrics with asset-based assessments — collateral can include tokenised property holdings and approved custodial digital assets where regulatory and product terms allow.

Processes emphasise speed, clarity and a single point of contact; commercial terms depend on jurisdiction, credit profile and collateral.

Finance for equipment, vehicles and specialised assets with flexible tenor and structured repayment schedules. We evaluate total cost of ownership, residual values and where appropriate accept approved asset tokens or custodial receipts as part of the security package.

Ideal for SMEs and leasing companies seeking predictable monthly servicing with transparent fees.

Simplify your liabilities and improve cash flow through consolidation, refinancing and covenant redesign. Our commercial restructuring team works with borrowers to create pragmatic repayment plans while protecting creditor value — solutions span bilateral refinancing, syndicated amendments and bespoke covenant waivers.

We prioritise sustainable outcomes that support business continuity and long-term creditworthiness.

Residential, buy-to-let and commercial mortgages crafted for investors, developers and private buyers. We offer fixed and variable options, bridging facilities and construction financing; for eligible deals we can structure asset-backed loans secured against tokenised property interests held in the Vault.

Valuation and title processes are coordinated with local counsel and custodial administrators to ensure seamless security perfection.

We provide pathways to credit access for businesses with past blemishes: tailored underwriting, staged credit facilities and improvement plans designed to rebuild financial profiles. Applications are assessed holistically — management track record, cashflow restoration and collateral quality all matter.

Responsible lending principles apply; affordability and sustainability are central to approvals.

For corporates, sponsors and portfolios seeking scale, we provide term lending, project finance and customised facilities up to institutional limits. Products are negotiated with transparent covenants, monitoring provisions and optional hedging overlays for interest rate and FX exposures.

Onboarding includes covenant testing, reporting cadence and integration with your Vault reporting suite.

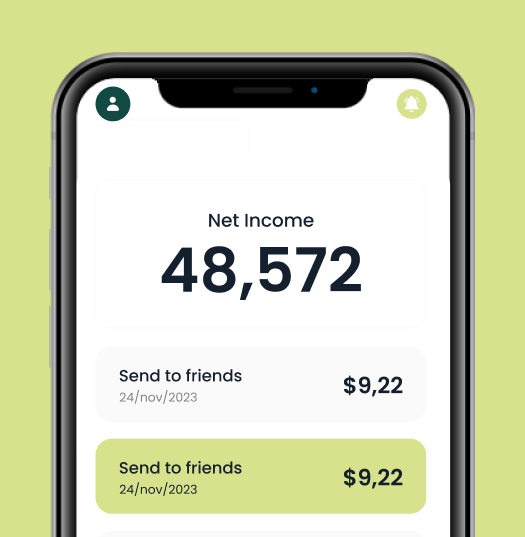

Vaulted Growth provides a single place to manage corporate cash, digital asset custody and structured lending. Our compliance-first onboarding, API treasury tools and relationship support make it easier to run operations, protect assets and access growth capital.

We offer multi-currency accounts, consolidated reporting, API access for programmable payments and sweep rules, FX execution through preferred liquidity providers, and segregated custody for corporate digital assets. Treasury customers can configure multi-signature approvals, role-based access and custom audit trails to meet internal controls.

Enterprise onboarding includes technical integration, legal documentation and agreed SLAs.

Where permitted and subject to regulatory and product terms, Vaulted Growth structures asset-backed facilities that accept approved custodial digital assets and tokenised real-estate interests as collateral. Collateral acceptance follows strict valuation, custody verification and margining rules; terms are bespoke and reflect asset type, liquidity and counterparty risk.

Contact our commercial team to discuss eligibility and indicative terms for your collateral package.

Onboarding includes corporate identity verification, beneficial ownership disclosure, AML/KYC screening, sanctions checks and enhanced due diligence where required. For accounts accessing custody or lending, additional documentation such as board resolutions, corporate authorisations and evidence of asset provenance may be requested.

Our teams will provide a tailored document checklist and guide you through secure document upload and verification.